About Transaction Advisory Services

Transaction Advisory Services Fundamentals Explained

Table of ContentsAbout Transaction Advisory ServicesSome Of Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedRumored Buzz on Transaction Advisory ServicesThe smart Trick of Transaction Advisory Services That Nobody is Talking About

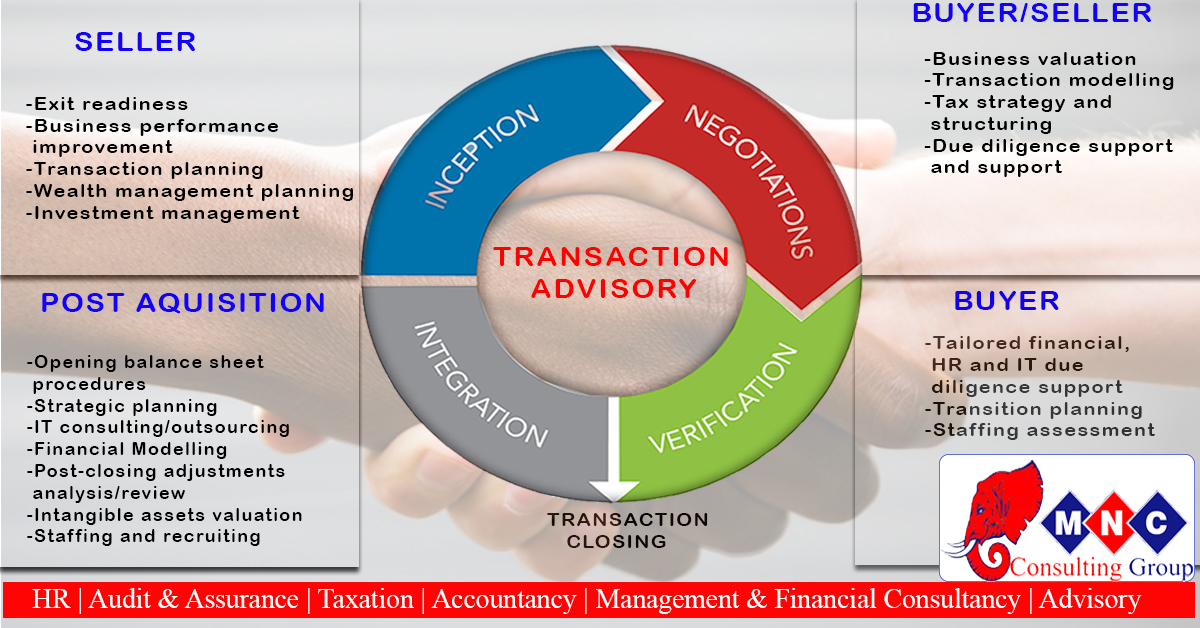

This step sees to it the service looks its finest to possible customers. Obtaining business's worth right is crucial for an effective sale. Advisors make use of various approaches, like discounted cash circulation (DCF) evaluation, comparing with similar business, and current purchases, to determine the reasonable market price. This helps establish a fair rate and discuss efficiently with future buyers.Transaction experts step in to aid by getting all the required information organized, responding to questions from buyers, and preparing sees to the business's place. Transaction consultants utilize their experience to assist organization owners take care of difficult negotiations, satisfy buyer expectations, and framework bargains that match the proprietor's objectives.

Meeting legal guidelines is critical in any kind of company sale. Deal advisory services collaborate with lawful specialists to create and examine agreements, agreements, and other lawful documents. This decreases threats and makes sure the sale follows the regulation. The function of deal consultants extends past the sale. They assist entrepreneur in preparing for their next steps, whether it's retirement, beginning a new endeavor, or handling their newly found riches.

Deal consultants bring a riches of experience and understanding, making sure that every element of the sale is managed skillfully. With calculated prep work, appraisal, and settlement, TAS helps local business owner attain the greatest possible sale price. By ensuring lawful and regulative compliance and managing due persistance along with various other offer team members, purchase consultants decrease prospective threats and obligations.

Examine This Report on Transaction Advisory Services

By contrast, Large 4 TS groups: Service (e.g., when a potential purchaser is carrying out due persistance, or when a deal is closing and the customer needs to incorporate the company and re-value the vendor's Balance Sheet). Are with costs that are not linked to the bargain shutting successfully. Earn charges per interaction someplace in the, which is less than what investment banks make even on "tiny deals" (however the collection probability is likewise a lot higher).

, yet they'll concentrate more on accountancy and evaluation and less on topics like LBO modeling., and "accounting professional just" topics check it out like trial balances and how to stroll with events making use of debits and credit scores rather than financial declaration modifications.

More About Transaction Advisory Services

that demonstrate just how both metrics have transformed based on items, networks, and clients. to evaluate the precision of management's past forecasts., consisting of aging, inventory by product, ordinary levels, and arrangements. to establish whether they're entirely fictional or somewhat believable. Professionals in the TS/ FDD groups might likewise interview monitoring concerning whatever above, and they'll write a detailed record with their findings at the end of the process.

The pecking order in Purchase Solutions differs a little bit from the ones in investment banking and exclusive equity professions, and the general shape resembles this: The entry-level function, where you do a great deal of information and economic evaluation (2 years for a promo from below). The following degree up; comparable job, yet you obtain the even more intriguing little bits (3 years for a promo).

In specific, it's hard to get advertised past the Supervisor level since couple of people leave the job at that stage, and you require to begin showing evidence of your capacity to produce profits to development. Let's start with the hours and way of living given that those are less complicated to explain:. There are occasional late nights and weekend break job, but nothing like the frenzied nature of financial investment financial.

There are cost-of-living adjustments, so expect lower compensation if you're in a less expensive place outside major financial (Transaction Advisory Services). For all positions look these up except Partner, the base pay comprises the bulk of the total compensation; the year-end benefit could be a max of 30% of your base pay. Commonly, the most effective method to raise your profits is to switch over to a different firm and discuss for a higher salary and incentive

The smart Trick of Transaction Advisory Services That Nobody is Talking About

At this phase, you ought to simply stay and make a run for a Partner-level function. If you desire to leave, perhaps relocate to a client and execute their appraisals and due persistance in-house.

The main trouble is that because: You generally need to sign up with an additional Big 4 team, such as audit, and job there for a couple of years and after that move right into TS, job there for a few years and then relocate right into IB. And there's still no guarantee of winning this IB function due to the fact that it depends on your region, customers, and the employing market at the time.

Longer-term, there is also some threat of and since evaluating a company's historic monetary info is not exactly brain surgery. Yes, people will certainly always require to be involved, yet with more advanced modern technology, lower head counts can potentially sustain customer interactions. That said, the Purchase Services team beats audit in regards to pay, job, and exit opportunities.

If you liked this short article, you may be curious about analysis.

The Ultimate Guide To Transaction Advisory Services

Develop sophisticated economic structures that assist in establishing the actual market value of a company. Offer advisory job in relationship to service appraisal to aid in negotiating and pricing frameworks. Discuss one of the most appropriate kind of the offer and the sort of consideration to employ (money, supply, earn out, and others).

Do assimilation planning my sources to determine the process, system, and business adjustments that might be required after the deal. Set guidelines for integrating divisions, modern technologies, and company procedures.

Determine potential reductions by decreasing DPO, DIO, and DSO. Evaluate the prospective client base, industry verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides crucial understandings right into the performance of the firm to be acquired worrying danger analysis and worth production. Recognize temporary alterations to financial resources, financial institutions, and systems.